The housing market is currently brimming with diverse options for prospective homeowners. As individuals embark on their homebuying journey, grasping the distinctions between modular vs manufactured homes becomes increasingly crucial.

Modular vs Manufactured Home

Understanding these differences between modular vs manufactured home is not merely a matter of choice but a fundamental necessity. In this blog post, we will actively delve into the intricacies of modular vs manufactured homes, aiming to provide readers with a comprehensive comparison. Read on!

What Is a Modular Home?

A modular home is a contemporary housing solution epitomizes efficiency and quality construction. These homes are constructed in a factory setting, where various components, known as modules, are fabricated with precision and attention to detail.

Modular homes are built in a highly controlled environment within a factory. Skilled artisans assemble each module, which includes structural elements, insulation, plumbing, and electrical systems. These modules are meticulously crafted to ensure consistency and durability. Once completed, these modules are transported to the homeowner’s chosen site.

One noteworthy feature of modular homes is their strict adherence to local, state, and regional building codes. Each modular home is engineered to meet the specific requirements of the area where it will be placed. This means modular homes must comply with the same stringent regulations governing traditional stick-built homes, ensuring they are structurally sound, safe, and energy-efficient.

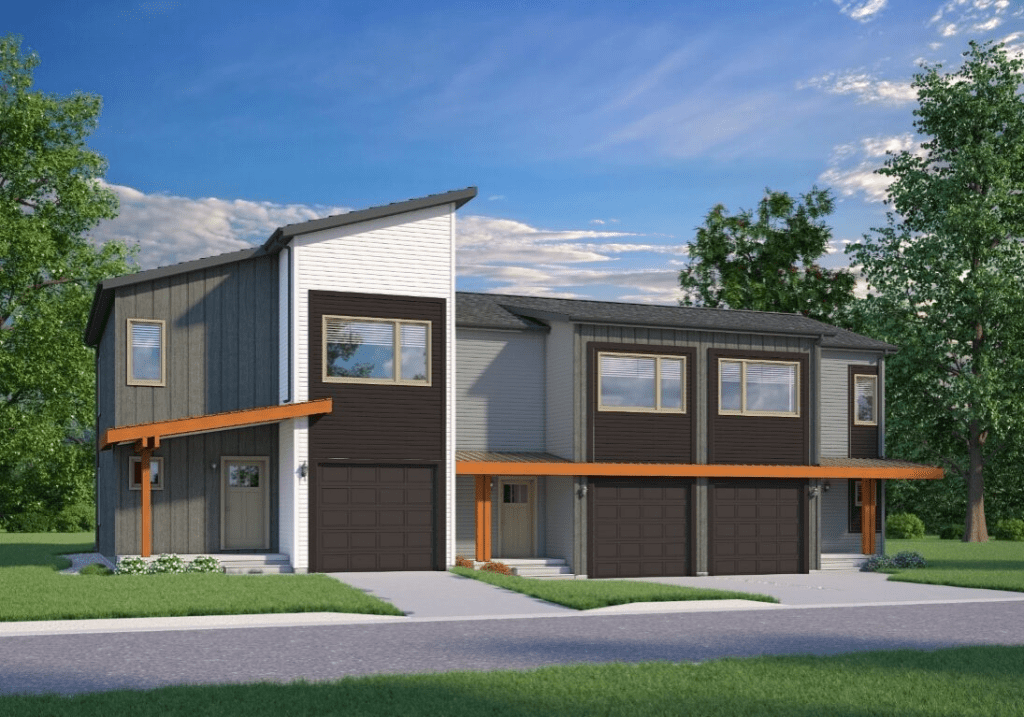

Modular homes share striking similarities with traditional stick-built homes. It can be challenging to distinguish between the two to the untrained eye. Modular homes are often placed on a permanent foundation, providing homeowners with a sense of permanence and stability akin to traditional home construction. The quality of materials and craftsmanship used in modular homes mirrors their stick-built counterparts.

Regarding financing, modular homes enjoy a wide range of options. Most banks and mortgage lenders offer financing tailored to modular homes. This means prospective buyers can access diverse financing avenues to facilitate their homeownership dreams. Institutions like Rocket Mortgage provide comprehensive financing solutions specifically designed for modular homes, making the buying process even more accessible and convenient for potential homeowners.

What Is a Manufactured Home?

Manufactured homes, or mobile homes, are prefabricated housing that has evolved significantly over the years. These homes are constructed in a controlled factory environment characterized by efficiency and precision.

The construction of manufactured homes entails assembling various components in a factory setting. Skilled workers construct these homes, including structural elements, insulation, plumbing, electrical systems, and interior finishes. Once assembled, the entire home is transported to its intended site.

The Federal HUD (U.S. Department of Housing and Urban Development) code is a pivotal aspect of manufactured homes. Established in 1976, this code sets rigorous federal standards that govern manufactured homes’ design, construction, and safety. It has transformed the industry, ensuring modern manufactured homes meet stringent quality, safety, and energy efficiency standards.

Unlike modular homes, manufactured homes have a unique mobility aspect. They are often built on a steel chassis, akin to an automobile. This mobility feature allows manufactured homes to be transported in one piece to a chosen site, either temporarily or permanently. It provides homeowners with the flexibility to relocate if desired.

An essential consideration for manufactured homes is the transition from chattel (personal property) to real property. In many cases, when a manufactured home is permanently affixed to a site, it can undergo a legal process that converts it from chattel to real property. This conversion is typically conducted through the county, enabling homeowners to establish a sense of permanence for their dwellings.

Financing options for manufactured homes may vary, primarily due to their chattel classification. While some lenders offer loans for these homes, it’s important to note that financing terms can differ from those of traditional mortgages. Additionally, certain government-backed loans, such as FHA (Federal Housing Administration) loans, may be available to facilitate the purchase of manufactured homes, offering potential homeowners a range of financial avenues to explore.

Key Differences Between Modular and Manufactured Homes

The construction processes of modular and manufactured homes diverge significantly. Modular homes are meticulously crafted in a factory, with various components assembled under controlled conditions. In contrast, manufactured homes are constructed as complete units within the confines of a factory.

One of the fundamental distinctions lies in the foundations. Modular homes are typically anchored on a permanent foundation, similar to traditional homes, providing stability and permanence. In contrast, manufactured homes often sit on a steel chassis designed for mobility, allowing them to be transported as a whole unit.

Modular homes are stationary once placed on their permanent foundation, with no inherent mobility. In contrast, manufactured homes maintain mobility, as they can be transported to different locations if needed, thanks to their steel chassis.

Modular homes are considered real once permanently affixed to their designated site, similar to traditional homes. Due to their potential for relocation, manufactured homes may start as personal property (chattel) and require a legal conversion process to attain real property status.

Financing options for modular homes are extensive, mirroring those available for traditional site-built homes. This comprehensive range of financing options offers potential homeowners flexibility and convenience. On the other hand, financing options for manufactured homes can be more limited, as they often involve personal property loans with varying interest rates.

Modular homes offer a higher degree of customizability compared to manufactured homes. With modular homes, homeowners can select from various floor plans, finishes, and design elements to create a personalized living space. Manufactured homes, while offering some customization, may have more limited design choices.

Modular homes must adhere to local, state, and regional building codes and standards like traditional homes. In contrast, manufactured homes are subject to the comprehensive Federal HUD Code, which governs their design, safety, and energy efficiency on a national level.

Modular homes are typically placed on private property, offering homeowners the autonomy of land ownership. Manufactured homes can be situated on private property as well. Still, they can also be placed on land leases within manufactured home communities, adding more flexibility regarding living arrangements.

Customizing Modular and Manufactured Homes

Modular home design has evolved significantly, offering various possibilities to cater to diverse preferences and needs. Today, modular homes come in various shapes and sizes, ranging from compact tiny homes to spacious two-story colonials. The vast customization potential allows homeowners to personalize their dwellings with features like attached garages, expansive wrap-around porches, and an extensive array of floorplans.

Modular homes are celebrated for their adherence to strict building codes and the fact that they are placed on a permanent foundation. This compliance ensures that most banks and lenders readily provide financing options, granting prospective homeowners access to many choices when purchasing their dream modular home.

While manufactured homes may not offer the same level of customization as modular homes, they still provide various opportunities for personalization. Newer manufactured homes are available in multiple architectural styles, floor plans, and optional add-ons to cater to individual needs and preferences.

Homeowners can select from different layouts and interior finishes to create a comfortable living space that suits their lifestyle. Although the degree of customization may be more moderate compared to modular homes, manufactured homes offer flexibility and choices to meet the unique requirements of their residents.

Financing Modular and Manufactured Homes

Securing financing for modular homes is a straightforward process akin to obtaining a mortgage for traditional site-built homes. These homes are treated as real property once assembled and placed on a permanent foundation. Consequently, they can be financed through conventional mortgage loans offered by banks and lenders. This extensive range of financing options provides prospective modular homeowners the flexibility and convenience to choose the loan that best suits their financial situation.

Financing options for manufactured homes may vary due to their classification as personal property or chattel. However, many lenders offer loans specifically tailored to accommodate the unique nature of manufactured homes. While interest rates may vary, prospective buyers can explore loan options that align with their budgetary requirements. Working with lenders experienced in manufactured home financing is essential to navigate the process effectively.

The Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) provide additional financing opportunities for manufactured homes. FHA loans for manufactured homes require a foundation inspection following the standards outlined in the Permanent Foundations Guide for Manufactured Housing.

If an inspection has been previously conducted and meets the criteria, it can be used to qualify for an FHA loan. VA loans are another option for eligible veterans looking to finance a manufactured home, making homeownership more accessible for those who have served in the military. These government-backed loan programs offer viable financing avenues for prospective manufactured home buyers, further expanding their options in the housing market.

Complying With Local Zoning Laws

Similar to traditional site-built homes, modular homes are subject to the regulations and requirements outlined in local zoning laws. These laws dictate various aspects of construction, including permissible land use, building size, setbacks, and aesthetic considerations.

Homeowners interested in modular homes must adhere to these zoning laws, ensuring their design and placement align with the local regulations. This compliance with local zoning laws underscores the similarity between modular homes and conventional homes, as the same rules and restrictions bind both.

Local ordinances and land use regulations specific to each area influence the placement of manufactured homes. These ordinances can restrict where manufactured homes can be situated and may impose conditions on their placement. For instance, some localities may have specific requirements regarding the type of foundation or support for manufactured homes, ensuring they conform to safety and stability standards.

Additionally, zoning ordinances may define the zoning districts where manufactured homes are allowed, helping to determine the available locations for these homes. It is crucial for prospective manufactured homeowners to research and understand local ordinances and zoning regulations to make informed decisions about the placement of their homes.

Modular and Manufactured Homes vs. Mobile Homes

To appreciate the evolution of modular and manufactured homes, it’s essential to consider the historical context of mobile homes. Mobile homes initially emerged as a response to the housing needs of the post-World War II era. These early mobile homes, often called “trailers,” were designed for mobility and resembled campers or trailers, complete with wheels and trailer couplers. However, these early mobile homes needed to adhere to uniform construction standards, leading to concerns about their quality, safety, and durability.

The transition from mobile homes to manufactured homes marked a pivotal shift in the industry. In 1974, the National Mobile Home Construction and Safety Act was enacted, setting the stage for federal regulation of mobile homes. This legislation addressed the quality and safety issues associated with mobile homes.

Two years later, the HUD Manufactured Home Construction and Safety Standards (HUD Code) were established, creating a comprehensive set of federal construction standards for manufactured homes. This transition transformed mobile homes into the modern manufactured homes known today, characterized by improved quality, energy efficiency, safety, and durability.

The HUD Code plays a central role in regulating the construction standards of manufactured homes. It governs various aspects of manufactured home design and construction, including its structural integrity, energy efficiency, thermal protection, plumbing, electrical systems, fire safety measures, and overall safety standards.

These stringent regulations ensure that manufactured homes adhere to uniform performance-based construction standards, promoting quality, durability, and affordability in the industry. Additionally, the HUD Code established mechanisms for resolving disputes between consumers, retailers, and manufacturers, further enhancing consumer protection and satisfaction.

The terminology has shifted, and mobile homes or trailers are now commonly called “manufactured homes.” This transition reflects the industry’s commitment to improved construction standards, safety, and the overall quality of these homes, setting them apart from their earlier mobile home counterparts.

Conclusion

In conclusion, understanding the differences between modular and manufactured homes is essential when venturing into prefab housing. Modular homes, constructed to local building codes, offer a close resemblance to traditional stick-built homes and provide a high degree of customization. They are considered real property, allowing for standard mortgage financing. On the other hand, manufactured homes are built according to the federal HUD code and can be moved, but they require conversion to real property for permanent placement. Financing options for manufactured homes may be more limited, although FHA and VA loans are available.

As you embark on your journey to homeownership, we encourage you to make an informed decision when choosing between modular and manufactured homes. Consider your budget, customization preferences, and the local zoning laws in your desired area. Whether you value a modular home’s permanence and customization options or a manufactured home’s affordability and mobility, there is a prefab housing solution to match your needs and lifestyle.

To delve deeper into prefab housing and explore additional resources, we recommend visiting the Rocket Mortgage Learning Center, where you can find valuable insights and guidance on various home buying, financing, and construction aspects. Whether you are a first-time homebuyer or an experienced homeowner, these resources can empower you to make well-informed decisions and embark on your journey to find the perfect home, modular, manufactured, or traditional site-built.